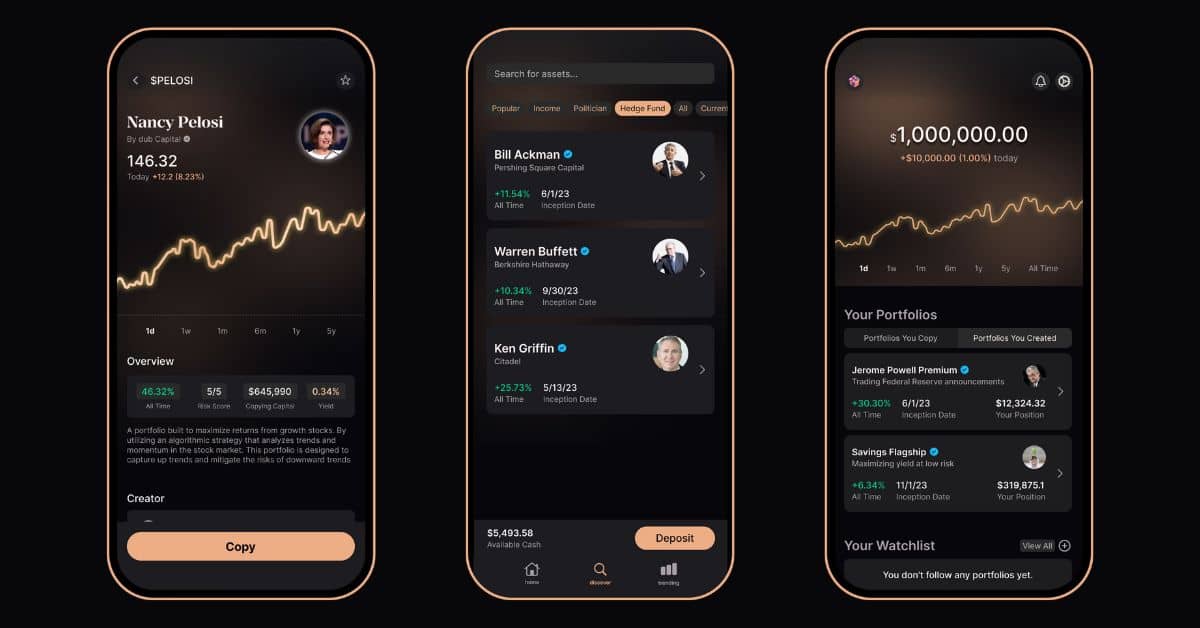

Dub, the copy trading app that’s taking the investment world by storm, allows users to mimic the trades of top investors, hedge funds, and even politicians like Nancy Pelosi with just a few taps.

Founded by Steven Wang, a 23-year-old Harvard drop-out, the app is targeting younger generations, particularly Gen Z, who are more influenced by social media personalities than traditional financial advisors.

The Influencer-Driven Investment Trend

In recent years, social media has reshaped everything from shopping to news consumption, and now Dub is aiming to do the same for investing. Instead of traditional stock-picking, Dub focuses on following people — from high-profile investors to even politicians’ public portfolios.

The app allows users to copy entire portfolios, making the decision-making process simple and accessible for anyone looking to tap into the investment world. For example, users can copy Nancy Pelosi’s trading moves, which has become a hot trend, with some claiming significant returns.

Rapid Growth and Revenue Model

Dub’s user base has exploded, reaching over 800,000 downloads. It raised $17 million in seed funding and is eyeing another investment round. The app charges a $10-per-month subscription fee and takes a 25% cut from the management fees of some top portfolios.

The app has also gained traction by advertising heavily on social media platforms like Instagram, where young investors have become keen to follow the financial moves of their favorite influencers.

Avoiding Pitfalls of Past Fintech Platforms

While Dub is rapidly growing, it’s working hard to avoid the pitfalls faced by other fintech startups like Robinhood, which faced regulatory scrutiny during its rise. Dub spent over two years working with regulators like FINRA and the SEC, making sure the platform complies with financial regulations.

Founder Steven Wang emphasizes that Dub is designed not only to help users copy trades but to educate them about the risks and rewards involved. The platform displays important data such as risk scores, portfolio stability metrics, and risk-adjusted returns to help users make more informed decisions.

The Criticism: Is Active Trading the Right Move?

Despite the growth, critics argue that active stock picking doesn’t usually outperform passive investing strategies, with many studies showing that most actively managed funds fail to beat the S&P 500.

However, Wang is quick to defend Dub’s model, pointing to the success of hedge funds like Citadel, which consistently generate returns for their clients.

For now, Dub seems to be carving its own niche in the fintech space, attracting users with a combination of social media influence and access to professional-level investing strategies. But whether the platform can avoid the pitfalls of past fintech giants remains to be seen.

Leave a comment