The recent boom and bust in quantum computing stocks (such as RGTI, QBTS, QUBT, IONQ) has sparked debate about whether this emerging field is a speculative “bubble” or the next AI revolution.

Investors are asking: Can quantum computing challenge classical computing? Is it investable? And could quantum computing one day outperform current technologies like Nvidia’s GPUs, which power AI?

Quantum computing promises “double exponential” speedup, far outpacing the linear speedup of classical computing. However, the practical application of quantum computing remains uncertain.

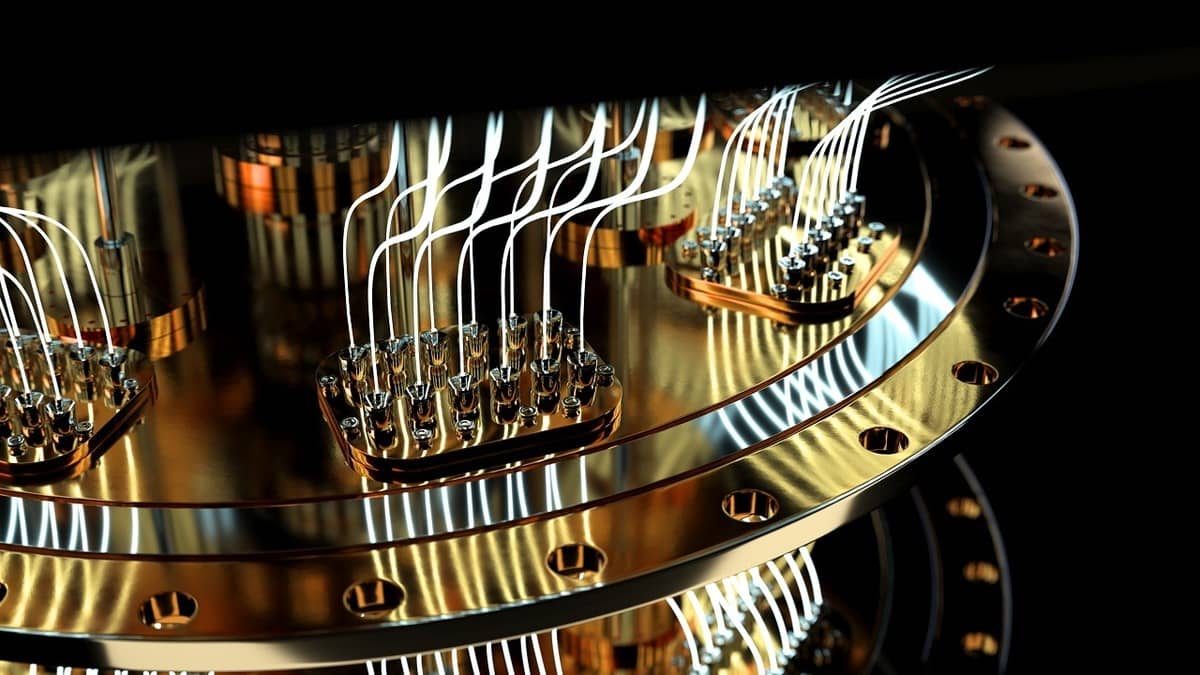

While quantum mechanics is a well-established scientific principle, the path to building practical quantum computers is fraught with challenges, including error correction and scaling issues. Some experts believe that, like AI, quantum computing could transform industries, but its timeline is unclear.

Despite this uncertainty, the quantum computing race is on. Companies like Nvidia are investing heavily in quantum technology, though they may be cautious about fully embracing it, fearing it could disrupt their current market dominance.

Investors face significant risks, as the upside potential of quantum computing could be massive, but the probability of success remains low.

Investing in quantum computing is speculative, but it could offer huge rewards for those willing to take the risk. The key is managing exposure carefully.

Following a “Kelly criterion” approach, investors should allocate a small portion of their portfolios to quantum computing stocks, balancing the potential for massive returns with the risk of total loss. The optimal allocation depends on the perceived probability of success and the potential payoff.

While quantum computing is still in its infancy, the technology’s long-term potential could make it a game-changer. However, investors must tread carefully, diversifying their bets and sizing their positions appropriately to manage the inherent risks.

Leave a comment