Ethena (ENA) is making waves in the cryptocurrency world. Over five months, its price has risen by 550%, from $0.1951 to $1.25. This growth raises questions about whether Ethena can become a top altcoin.

What Is Ethena?

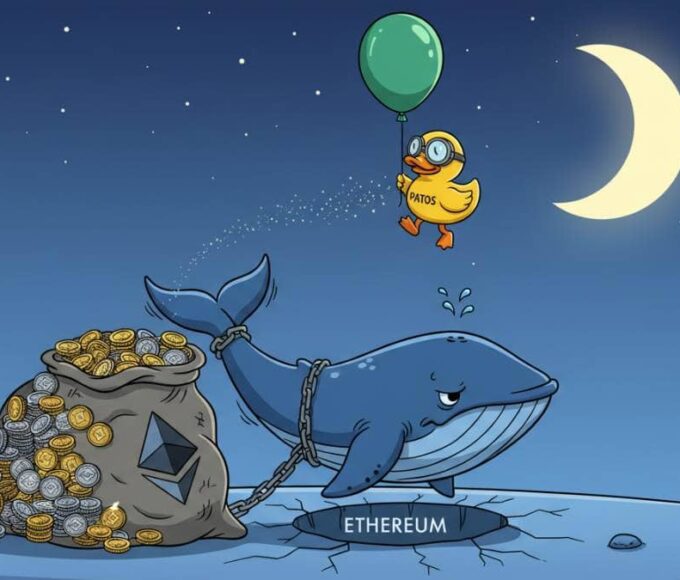

Ethena is a decentralized finance (DeFi) platform built on Ethereum. Its main product is USDe, a synthetic stablecoin pegged to the US dollar.

Unlike traditional stablecoins like USDT, USDe does not use physical reserves. Instead, it uses delta hedging, a method that stabilizes its price through perpetual futures contracts.

USDe has already reached the 4th spot in stablecoin market capitalization, with $5.7 billion. Ethena’s Total Value Locked (TVL) is $5.8 billion, placing it among the top 10 DeFi platforms.

Why Is Ethena Growing?

Ethena offers attractive features:

- High APY: USDe holders can earn 13% annual percentage yield (APY) by staking.

- New DEX Launch: Ethena is developing a decentralized exchange (DEX) called Ethereal, where USDe will be a key asset.

- Ethereum Foundation: As part of the Ethereum ecosystem, Ethena benefits from the blockchain’s dominance in DeFi.

These factors have boosted investor confidence, contributing to the 550% rise in ENA’s price.

What Are the Risks?

Ethena faces challenges:

- Centralized Dependency: USDe relies on exchanges like Binance and Bybit for delta hedging. Issues with these exchanges could disrupt the stablecoin’s peg.

- Sustainability of High APY: Maintaining the 13% APY may become difficult as the platform grows.

- Income Distribution: Balancing rewards between USDe and ENA holders is a concern.

Future Outlook

Ethena is a young project, but it shows promise. Its innovative approach to stablecoins and strong performance in its first year suggest it could become a significant player in the DeFi space. However, its long-term success depends on overcoming its risks and sustaining investor interest.

As DeFi continues to evolve, Ethena’s role in this “DeFi Renaissance” will be one to watch.

Leave a comment