If you’re looking to invest in AI stocks in 2025, Nvidia (NVDA) and Meta Platforms (META) are solid picks. Both companies have capitalized on the AI boom and show strong growth potential in the coming year.

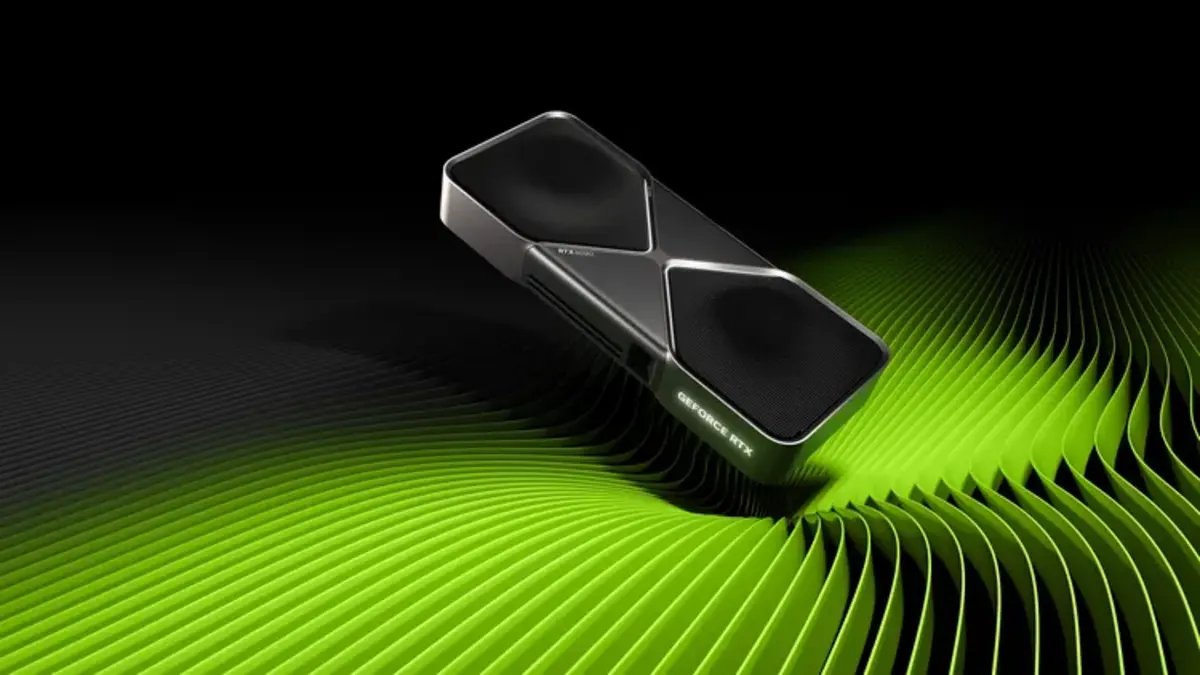

Nvidia: The AI Leader

Nvidia has become the go-to company for AI infrastructure, primarily due to its graphics processing units (GPUs) and CUDA software, which have set the standard for AI computing.

As more companies invest in AI, Nvidia stands to profit. Analysts predict Nvidia’s revenue will grow by 52% in fiscal 2026, driven by its Blackwell-architecture chips, which are significantly faster than previous models in training AI.

Despite concerns about its stock price, Nvidia’s 47x forward earnings ratio is justified by its rapid growth. Compared to other tech giants like Apple (AAPL) and Amazon (AMZN), Nvidia’s growth rate supports the premium price.

Meta Platforms: AI and Social Media

Meta is investing heavily in AI to enhance its social media platforms—Facebook, Instagram, WhatsApp, and Messenger—which generate most of its revenue through ads.

While Meta’s ventures into augmented reality (AR) and virtual reality (VR) are still in development, its AI efforts are already paying off in its core business.

With a 24x forward earnings ratio, Meta is reasonably priced for a tech stock, especially considering its growth potential if its AI-driven products succeed. Meta is a solid bet for those looking for a stable AI investment with significant upside.

Should You Invest $1,000 in Nvidia or Meta?

Both companies are well-positioned in the AI space, with Nvidia leading the charge in hardware and Meta making strategic AI investments to bolster its advertising business.

While Nvidia may be pricier, its growth prospects make it a compelling choice. Meta, on the other hand, offers a more affordable entry point with strong growth potential in the social media and AI sectors.

Consider diversifying your $1,000 investment between these two companies to take advantage of their complementary roles in the AI ecosystem.

Leave a comment