TikTok star Khaby Lame’s recent deal with Hong Kong-based Rich Sparkle Holdings has drawn attention from experts, who say the arrangement raises questions about its legitimacy. The deal briefly valued Lame’s stake at $6.6 billion.

Rich Sparkle announced in January that it acquired Lame’s company, Step Distinctive Limited, in a $975 million all-stock transaction. The deal promoted Lame as a controlling shareholder, with an AI “digital twin” of him used for future projects.

Following the announcement, Rich Sparkle’s stock soared more than 650%, peaking at $180.64 per share on January 15. This gave Lame’s 41% stake a paper value of $6.6 billion. However, the stock soon crashed 77%, dropping to $41 per share.

Experts have criticized the deal. Brenda Hamilton, a securities attorney, said the company changed business direction rapidly and issued large amounts of stock, raising “red flags.” Another analyst compared the stock surge to patterns seen in Chinese stock promotions, where small firms’ shares spike artificially.

Rich Sparkle’s financial history is limited. The company had reported 2024 revenue of under $6 million from printing financial materials and went public just six months ago with a $50 million valuation. Questions remain about whether Lame actually sold shares or realized any of the gains.

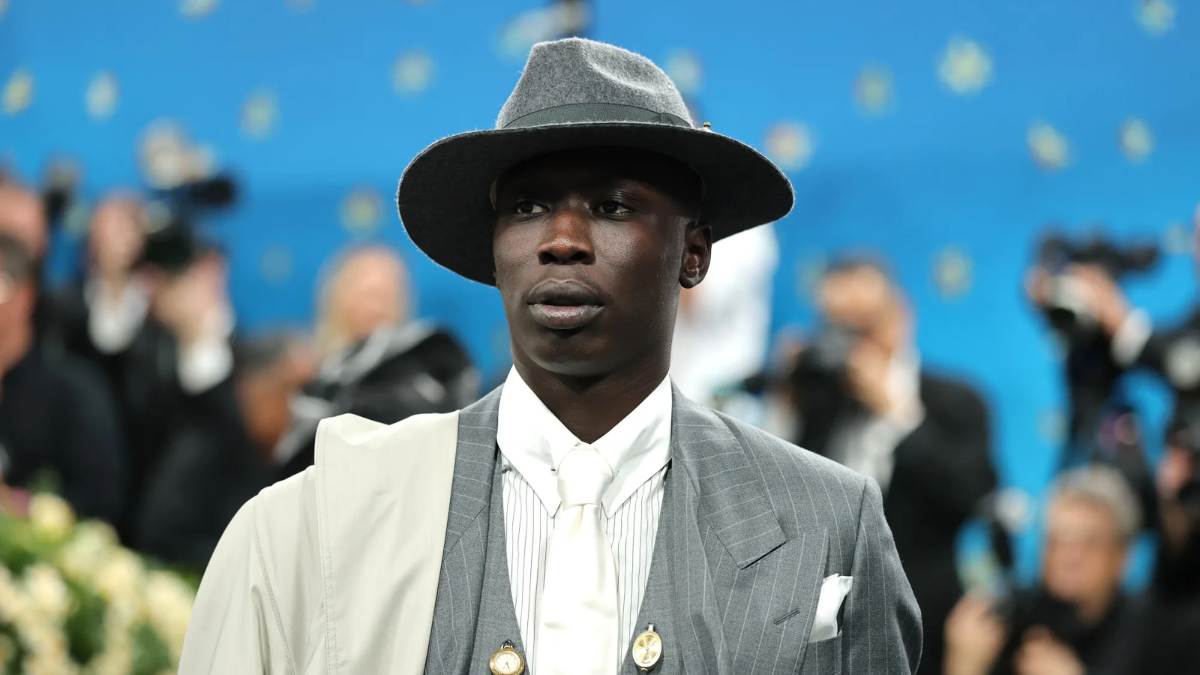

Khaby Lame, who has over 160 million TikTok followers, said on social media that he was “excited to be a shareholder” but provided no details about his financial stake. Forbes estimates his net worth at $3 billion, not the $6.6 billion suggested by the stock peak.

The deal has sparked debate about hype-driven stock valuations, the role of celebrity influence in financial markets, and investor risk. Experts warn that rapid stock spikes followed by crashes can leave ordinary investors exposed.