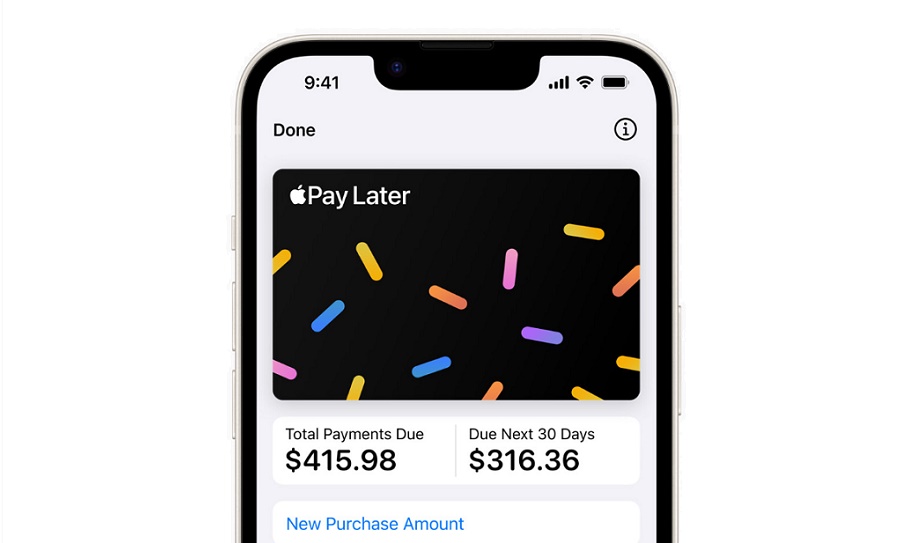

In a surprising move, Apple is discontinuing its Pay Later service less than a year after launching it in the United States. The Pay Later feature allowed Apple users to split purchases from $50 to $1,000 into four interest-free installments paid through Apple Wallet.

The service, introduced in 2022 in partnership with Mastercard and Goldman Sachs, will be replaced by a built-in capability in the upcoming iOS 18 operating system update. This new functionality will enable third-party buy now, pay later (BNPL) lenders, such as Affirm, to offer installment loans at checkout when customers use Apple Pay.

According to a statement from Apple, the change aims to “bring flexible payments to more users in more places across the globe, in collaboration with Apple Pay enabled banks and lenders.”

At Apple’s Worldwide Developers Conference (WWDC) in June, the company announced that major lenders, including Citigroup, Synchrony Financial, and Apple Pay issuers using Finserv software, would be able to issue BNPL loans through Apple Pay in the United States.

While existing Pay Later loans can still be paid off and tracked in Apple Wallet, no new loans will be offered through the defunct service after the transition later this year when iOS 18 launches in September.

The move signals a strategic shift for Apple, leveraging the ubiquity of Apple Pay to facilitate third-party lending integrations rather than operating its own BNPL program. It remains to be seen how this change will impact the user experience and what terms and conditions BNPL lenders will offer through Apple’s platform.