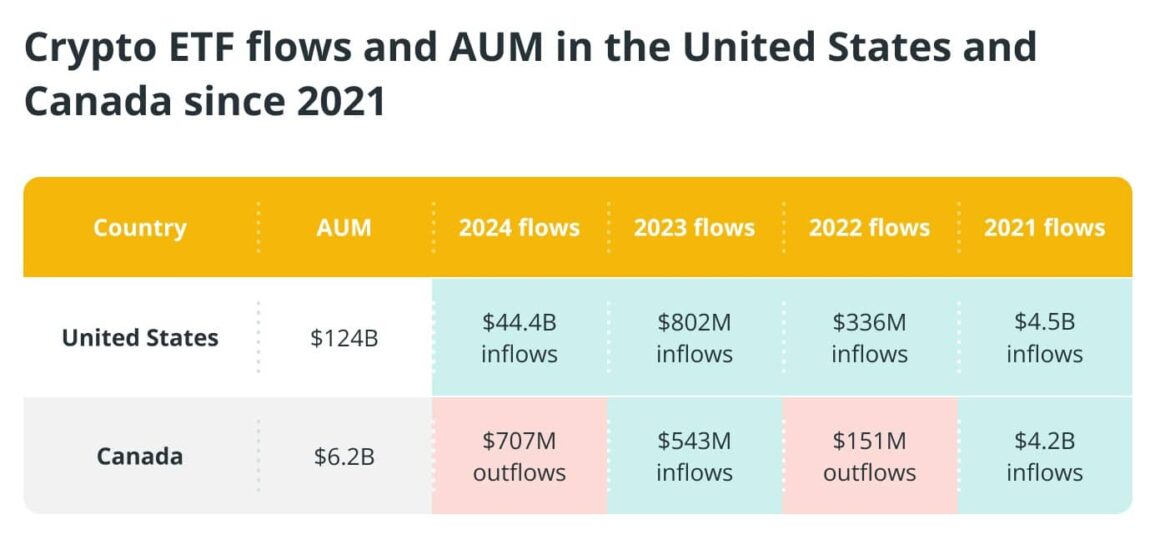

In 2024, the United States emerged as the leader in spot Bitcoin exchange-traded funds (ETFs), drawing in $44.2 billion in inflows and cementing its position as the largest holder of Bitcoin ETFs globally.

Meanwhile, Canada, the first country to launch a spot Bitcoin ETF in 2021, faced record outflows of $707 million as investors shifted to more liquid US alternatives.

US Bitcoin ETF Success

The US dominance in Bitcoin ETFs followed the Securities and Exchange Commission’s landmark approval of spot Bitcoin ETFs in January 2024.

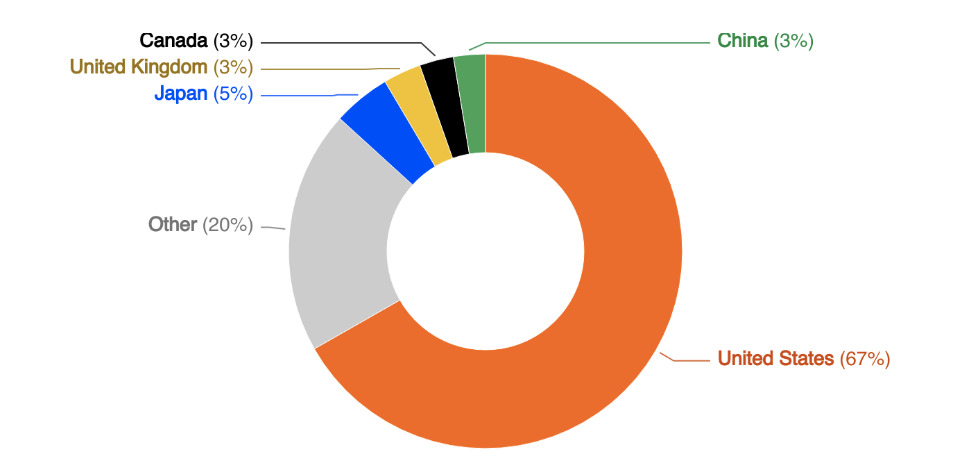

With the US being the largest ETF market globally, holding over 70% of global ETF assets under management (AUM), this success was anticipated.

According to industry experts, US investors are historically more open to risk and innovation, particularly in technology.

This, combined with decades of trust in ETF structures, made the US market a natural leader in crypto ETFs.

Canada’s Decline

Canada, once a pioneer in Bitcoin ETFs, saw its crypto ETF market shrink significantly in 2024. The country recorded its largest-ever outflows, surpassing the previous record of $151 million in 2022.

The Canadian Purpose Bitcoin ETF, launched in February 2021, initially saw tremendous success, with $564 million in assets under management within five days.

However, the debut of US Bitcoin ETFs shifted investor behavior, leading to a preference for US-based funds offering higher liquidity and broader institutional support.

Investor Shift

The migration of funds from Canadian to US ETFs highlights the impact of regulatory arbitrage. When the US lacked spot Bitcoin ETFs, Canadian funds benefited from international investors seeking exposure.

Once US options became available, these investors quickly moved their funds, leaving Canadian ETFs as the only category in the country to see outflows in 2024.

Future Outlook

With the US now dominating the global Bitcoin ETF market, experts suggest it’s unlikely any other country will surpass its AUM in the near future.

However, European markets continue to innovate with diverse offerings like staking yields in crypto ETFs, showcasing a potential avenue for competition.

Stay tuned for updates on the evolving crypto ETF landscape.

Leave a comment